UBS Evo eInvoicing Software in Malaysia

Now enhanced with AI-enabled features for smarter, more intuitive accounting, billing and inventory.

LHDN Compliant eInvoicing Software in Malaysia

Enhance your cash flow management and streamline business operations through electronic invoicing (eInvoice), the recently endorsed standardised method by the LHDN for exchanging invoices directly between suppliers’ and buyers’ software. Transmit and receive invoices swiftly, securely, and effortlessly, regardless of whether both parties use Access software.

Why eInvoicing?

eInvoice, mandated by the Inland Revenue Board (LHDN) of Malaysia, aims to enhance business efficiency and curb tax evasion. The implementation will occur gradually, starting in August 2024.

The eInvoice workflow begins with a sale or transaction. Suppliers issue eInvoices through the MyInvois Portal or API. Validated eInvoices are stored in IRBM’s database, allowing taxpayers to view their historical eInvoices. This system simplifies the invoicing process, making it efficient and accessible for businesses of all sizes.

Take back control

Say goodbye to misplaced invoices and uncertainties about payment statuses. Easily monitor when your invoices are received, approved, and processed. Track your invoices seamlessly from initiation to completion.

Save time & money

eInvoice ensures compliance with regulations while cutting costs and boosting efficiency. According to LHDN guidelines, switching to einvoicing can reduce processing costs by up to 80%. Businesses adopting einvoice also receive payments faster, improving cash flow and financial stability.

Secure & Compliant

Seamless system integration ensures accurate tax reporting and aligns financial processes with digital industry standards, enhancing efficiency.

Good for the planet

Bid farewell to traditional paper invoices and email attachments in PDF format that require printing and manual review. Embracing digital invoices reduces paper usage, contributing to a greener environment – a feature everyone can support.

When do you need to start eInvoicing?

The implementation will occur gradually, starting in August 2024 as below:

1 Aug 2024 – For businesses with an annual turnover of RM100 million or more

1 Jan 2025 – Businesses with an annual turnover of RM25 million to RM100 million

1 Jul 2025 – Businesses with an annual turnover of RM500,000 to RM25 million

1 Jan 2026 – Businesses with an annual turnover of RM150,000 to RM500,000

*Businesses with an annual turnover of RM150,000 will be exempted.

*Based on LHDN updates as of 21 February 2025

What can you do to prepare for eInvoicing?

As the shift to eInvoicing approaches, here are the key steps to ensure you’re prepared for a seamless transition:

Assess current invoicing processes

Evaluate your current invoicing processes for enhanced efficiency and reduced costs. Identify areas for improvement to stay ahead in the game.

Integration with Access UBS

Integrate eInvoicing with Access UBS to automate tasks, save time , and ensure timely, error-free payments. Streamline your financial processes effortlessly.

Team & client education

Communication is key! Educate your teams and clients about the impending changes. Ensure everyone is on board for a smooth transition into eInvoicing.

UBS eInvoicing e-Learning course

Learn about the basics of eInvoicing, the required version of UBS software, and the steps to set up and manage eInvoicing for your business. The content will be presented in easy-to-digest sections, incorporating interactive screens.

Safe, Secure & Reliable

Experience peace of mind with LHDN eInvoice – it’s safe, secure, and utterly reliable. Your data seamlessly integrates into your accounting software with just a click, streamlining your financial processes effortlessly.

Minimise Errors and Increase Efficiency

By eliminating manual tasks such as sorting, printing, and data entry, eInvoice significantly reduce the chances of human error. This streamlined process removes the potential for mistakes and saves valuable time that would otherwise be spent on invoice processing. The technology relies on standardized data, ensuring validation before the invoice reaches your accounting software and is automatically processed, guaranteeing accuracy in your financial records.

Need help with UBS Evo?

- Explore our Knowledge Base for comprehensive guides, best practices and

troubleshooting tips on UBS Evo. - For quick answers to common questions, visit our eInvoicing FAQ page.

UBS Evo, Your AI-Powered Accounting Assistant

Transform your business finances with UBS Evo eInvoicing. Discover the new AI-enabled software that gives you the freedom to do more, leaving behind inefficient manual invoicing, escalating operating costs, and affecting profitability and payment processing. Whether it’s eInvoicing compliance with LHDN or tax-specific requirements, UBS Evo adapts to your business needs seamlessly.

It’s time to experience the future of finance and let your AI-powered accounting companion handle your financial processes effortlessly while you focus on what

matters most—growing your business. It’s not magic, it’s Evo.

The secret, intelligent weapon - AI and UBS

Have your personal AI assistant to retrieve the data that you need and answer simple questions, intuitively on your business data, based on the information you upload. Saving time and increase productivity.

Leave the simple tasks to your AI assistant

Access Evo is designed to allow you to deliver a better result, more accurately, with faster time. Enabling more results with lesser time.

All in real-time

Partnering with Microsoft, our specialised AI is designed to be versatile and match your business needs, anywhere, anytime. Be it information within the general areas of einvoicing compliances by LHDN, to a more tax specific that is related to your products or services. All within seconds.

Your evolution starts today

With the idea to help you focus on what’s important, UBS Evo is here to streamline your daily tasks better, subsequently helping you to elevate your growth to the next level.

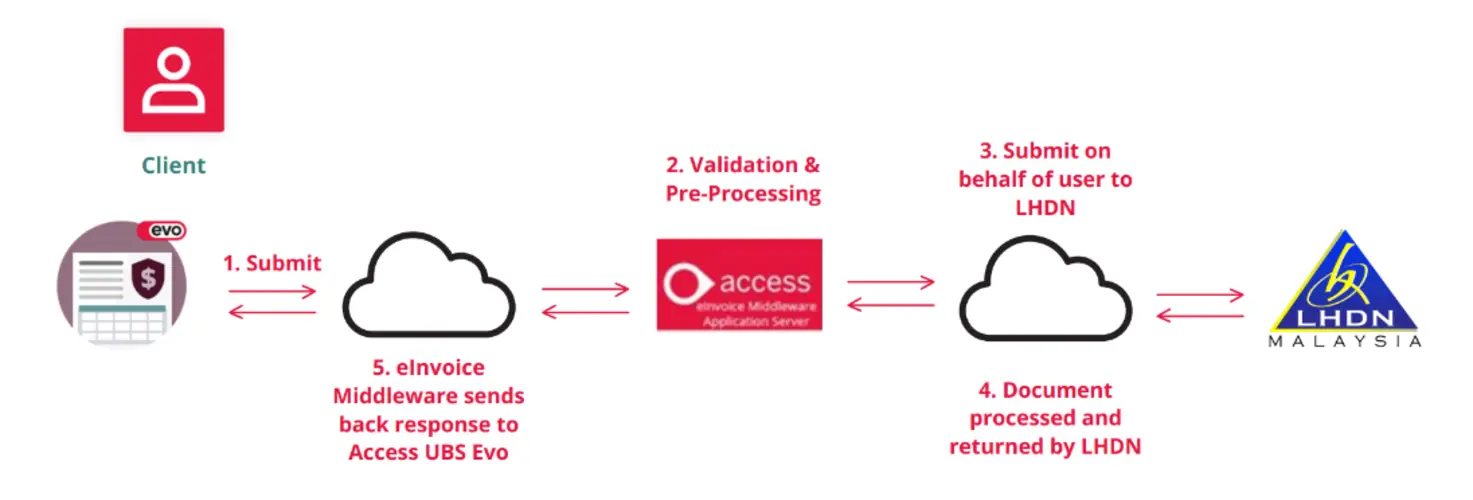

UBS eInvoicing as Intermediary Party

User Journey: eInvoice Scenarios

Explore eInvoicing scenarios and see how UBS Evo simplifies every step—from creation to compliance—ensuring seamless, error-free transactions.

eInvoicing in Action

Watch how CoPilot intuitively interacts with your eInvoice-related quiries.

AI at Work: How it’s reshaping the workplace in Malaysia

The rapid adoption of artificial intelligence (AI) in the workplace is revolutionizing operations, enhancing efficiency, and enabling employees to accomplish more. Our research has indicated that 93% of AI adopters experienced positive impact.

As part of our commitment in delivering the best solutions, we conducted multiple surveys on AI adoption within organisations in Malaysia and here are the results:

Artificial Intelligence (AI) Adoption within UBS Customers in Malaysia

Artificial Intelligence Adoption on the Rise

%

of organisations surveyed have already implemented AI or are actively exploring AI adoption in the near future.

Who Will be Using AI?

%

of organisations surveyed noted that AI will be used across multiple departments, with another 24% citing that AI will be used in their finance and operations teams.

Challenges: Costs and

Data Security

%

expressed worries about implementation costs, with 21% citing data privacy and security as another cause for concern despite the advantages of AI in the workplace.

The future of work is AI-enhanced, where human ingenuity and machine precision work together to drive innovation and growth.

As AI continues to evolve, its role in the workplace will expand. Organisations that embrace AI and invest in their employees’ skill development will see the greatest benefits.